Navigate Your Online Income Tax Return in Australia: Necessary Resources and Tips

Navigating the online income tax return procedure in Australia calls for a clear understanding of your commitments and the sources offered to streamline the experience. Crucial papers, such as your Tax Obligation Data Number and earnings declarations, must be thoroughly prepared. Additionally, choosing a proper online system can considerably impact the performance of your declaring procedure. As you take into consideration these aspects, it is crucial to likewise recognize common challenges that several experience. Recognizing these subtleties can inevitably conserve you time and lower stress and anxiety-- leading to a much more desirable result. What approaches can best help in this undertaking?

Comprehending Tax Obligations

Understanding tax responsibilities is essential for people and organizations operating in Australia. The Australian tax system is governed by various regulations and policies that need taxpayers to be aware of their obligations. People must report their revenue precisely, that includes salaries, rental income, and investment incomes, and pay taxes as necessary. Citizens have to comprehend the difference between taxable and non-taxable income to guarantee conformity and enhance tax end results.

For organizations, tax obligation commitments incorporate numerous aspects, consisting of the Item and Provider Tax (GST), firm tax, and pay-roll tax obligation. It is vital for services to register for an Australian Service Number (ABN) and, if applicable, GST enrollment. These responsibilities require careful record-keeping and prompt entries of income tax return.

In addition, taxpayers must know with readily available deductions and offsets that can relieve their tax problem. Seeking guidance from tax specialists can supply important insights into enhancing tax obligation positions while making certain compliance with the regulation. On the whole, a detailed understanding of tax responsibilities is vital for efficient monetary preparation and to avoid fines associated with non-compliance in Australia.

Important Records to Prepare

Furthermore, put together any pertinent financial institution declarations that mirror passion earnings, in addition to reward statements if you hold shares. If you have other sources of earnings, such as rental residential properties or freelance work, guarantee you have records of these incomes and any type of linked expenditures.

Think about any personal health and wellness insurance policy statements, as these can influence your tax obligation commitments. By gathering these essential papers in advancement, you will improve your on the internet tax return procedure, decrease mistakes, and optimize prospective refunds.

Picking the Right Online System

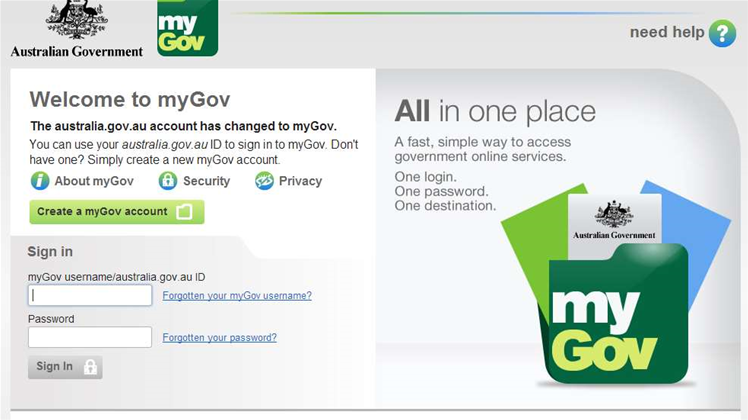

As you prepare to submit your on the internet tax return in Australia, picking the right platform is vital to make certain accuracy and simplicity of usage. Several crucial factors should assist your decision-making procedure. Consider the system's individual interface. A straightforward, instinctive layout can dramatically enhance your experience, making it less complicated to browse intricate tax kinds.

Following, evaluate the system's compatibility with your economic situation. Some services cater especially to people with easy income tax return, while others supply thorough assistance for a lot more intricate scenarios, such as self-employment or financial investment earnings. Look for platforms that offer real-time error checking and support, assisting to reduce blunders and making certain conformity with Australian tax laws.

One more important aspect to take into consideration is the level of client support readily available. Reputable systems must provide accessibility to assistance using phone, chat, or email, specifically during optimal declaring durations. In addition, research user reviews investigate this site and ratings to gauge the total fulfillment and integrity of the platform.

Tips for a Smooth Declaring Refine

Submitting your on-line tax return can be a straightforward process if you follow a couple of vital pointers to make sure efficiency and precision. This includes your earnings statements, receipts for deductions, and any kind of various other relevant paperwork.

Next, benefit from the pre-filling feature provided by numerous on-line platforms. This can save time and lower the chance of blunders by instantly occupying your return with info from previous years and information provided by your employer and banks.

Additionally, confirm all entries for accuracy. online tax return in Australia. Errors can lead to delayed refunds or issues with the Australian Tax Office (ATO) Make sure that your individual information, revenue figures, and deductions are right

Declaring early not just reduces stress yet also allows for far better preparation if you owe tax obligations. By complying with these suggestions, you can navigate the on-line tax return process smoothly and confidently.

Resources for Support and Support

Browsing the intricacies of online income tax return can in some cases be difficult, yet a variety of resources for help and support are readily offered to assist taxpayers. The Australian Taxes Office (ATO) is the key source of info, providing detailed overviews on its site, including FAQs, educational video clips, and live chat options for real-time aid.

Additionally, the ATO's phone support line is offered for why not try here those that prefer direct interaction. online tax return in Australia. Tax experts, such as licensed tax obligation agents, can also offer personalized guidance and guarantee conformity with present tax obligation laws

Conclusion

Finally, properly browsing the on-line tax obligation return process in Australia needs a complete understanding of tax obligations, thorough prep work of crucial papers, and mindful choice of an appropriate online system. Sticking to practical suggestions can improve the declaring experience, while readily available resources provide beneficial support. By approaching the procedure with diligence and focus to information, taxpayers can make certain compliance and make best use of potential advantages, eventually contributing to a more effective and effective tax return outcome.

As you prepare to file your on-line tax return in Australia, selecting the right system is crucial to make Web Site sure precision and simplicity of use.In verdict, properly navigating the on-line tax obligation return process in Australia calls for a thorough understanding of tax obligation responsibilities, meticulous prep work of necessary records, and mindful option of an appropriate online system.